Originally published on Citrix Blogs

Without question, “How big is the hosted desktop market” is the top inquiry I get from our Citrix Service Provider (CSP) partners.

Our thousands of global partners are constantly making investments in infrastructure, marketing, business operations and sales. And frequently they are going to their board (and sometimes to external investors) for funding to chase the high-margin, high-value hosted desktop market.

The problem is, how do you estimate the size of a market that’s so relatively new that it hasn’t yet been tracked? Well, it turns out that some surveys have already been taken, and that there are also a number of “adjacent” markets that will convert to hosted desktops….

What is a cloud-hosted desktop? Desktop-as-a-Service?

First, let’s define terms. Traditionally, your “desktop” (typically Microsoft Windows) is the container for all of your personal and workplace productivity apps. It’s your customized environment with your data and personalization information – not to mention being protected by your security credentials. This environment is also traditionally run locally on your personal hardware (laptop, desktop, etc.).

Enter Virtual Desktops. These can be fully-functional desktops – complete with apps, personalization and security – but their software physically runs on a server elsewhere… but typically somewhere on the same network in the same business, and typically on a server in a datacenter. These server-based desktops are owned and managed by the company’s IT department, and then provided to each user.

However, the cloud-hosted virtual desktop goes one step further. It runs on a server, but perhaps in a 3rd-party data center that is off-premesis. Its data and user experience is delivered over the public internet. The 3rd party is typically a managed service provider (MSP) under contract by the business to provide and maintain desktops. The user can expect an identical desktop & application experience… except all of the compute power resides somewhere in “the cloud”.

Some now term the cloud-hosted desktop model “Desktops-as-a-Service” (DaaS) in that the desktop is no longer considered local executable software. Rather, it is delivered and managed as an on-demand internet service – meaning it can be turned on/off at will, and billed-for as an hourly, daily, or (typically) monthly service.

Why is Cloud-Hosted DaaS so new?

To be honest, for as long as we’ve had the notion of cloud computing, there’s been the desire to host desktops. But the inhibitors revolved around two main areas: Physics and the more mundane aspect of licensing. While the licensing aspect of a 3rd-party owning desktop licenses has been solved-for, it took longer to work around Nature. The internet’s networks needed to be faster and have lower latency – two factors that contribute to the user experience.

The good news is that both of these issues have been solved-for to the satisfaction of all involved.

OK: So how big is the market? What’s the Opportunity?

Since the market for DaaS is so new, we’ll have to look at a variety of existing and adjacent metrics. We’ll also have to use some best-guess methods to gauge the opportunity.

Note that a number of these statistics are excerpts from research from a number of analysts/sources. Complete reports not in the public domain are only available from the analysts themselves.

- The existing Desktop Outsourcing market. This is defined as the desktop owner (usually running desktops locally) turning to a 3rd-party to manage and maintain those desktops. According to Gartner Research, the worldwide market for this is nearly US$30 billion. One could expect that over time, some percentage of the companies in this category would instead turn to a cloud-hosted model for maintenance and support – rather than continue a model of local execution and outsourced maintenance. Even a 1% shift of this market would translate into a DaaS market of US$300 million.

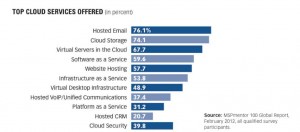

- As a % of cloud services offered. MSPmentor, in their 2012 Global Report (part of TalkinCloud), notes that Virtual Desktop Infrastructure (VDI) represents is offered by 48.9% of the top 100 MSPs. (note that some of this number probably includes on-premesis VDI hosting) While revenue breakdown numbers for services-offered is not available, the top 100 MSPs annual recurring revenue in 2011 was over US$1 billion. If even a small fraction of a given MSP’s revenue mix includes cloud-based desktop hosting, we still have the makings of a healthy market.

- The broader Desktop Virtualization Market. According to The 451 Group, the market for the Desktop Virtualization Ecosystem Market is estimated at US$5.6 billion by 2016. (This includes server-, client- and cloud-based hosting; session-based computing; application virtualization; management). Again, if even a few percent of the cloud-based hosting component manifests itself, we easily have a market in the hundreds of millions of $US.

- Hosted Workspace-as-a-Service market. Again, this market definition varies from pure DaaS. But according to a recent IDC study, the total WW market by 2016 is estimated in excess of US$661 million.

What We Still Need

Surprisingly few industry analysts and associations formally track DaaS. Neither MSPmentor, MSPalliance, nor The Web Host Industry Review track the DaaS market as they do other traditional hosting statistics – nor do they index which leading MSPs, CSPs and HSPs offer cloud-hosted desktops, DaaS, etc. I certainly hope that changes soon.

However, the news is good on 2 fronts. For the service providers, the opportunity to host desktops is new, growing, and highly profitable. And for the enterprise users, hosted desktops represent a new world where your workspace is available anywhere, anytime, and not subject to hardware failure/loss.

Stay tuned for another Blog in this series that will further help outline the opportunity for hosted desktops and workspaces. [ Part 2 Here ]

No comments:

Post a Comment